6 EASY STEPS TO DO YOUR GST REGISTRATION

May 14, 2020

WHAT IS A SALES TAX IMPLICATION?

May 19, 2020WHAT IS THE PUBLIC FINANCE TAX

Public finance is the administration of a country’s resources, investments, and shares loads through various company registration services and government institutions. This guide provides an overview of how public finances are managed through company registration in Karachi, what the various elements of public finance are, and how to quickly understand what all the numbers indicate. A country’s economic environment can be assessed in much the same way as a business’ financial reports.

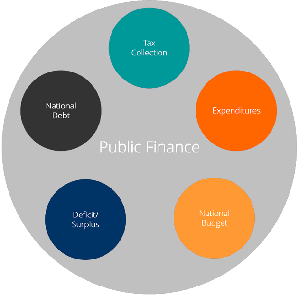

COMPONENTS OF PUBLIC FINANCE

The main elements of public finance throughcompany registration services include projects compared to collecting revenue, making expenditures to support society, and achieving an investment strategy (such as issuing government bonds). The main elements include .

TAX COLLECTION

company registration in Karachi tax collection is the principal income source for states. Examples of taxes collected by governments and company registration services include sales tax, income tax (a type of regular tax), property tax, and business tax. Other types of revenue in this category include charges and tariffs on imports and income from any type of public service that are not free..

BUDGET

The statement is a plan of what the government intends to have as expenses in a financial year. In the U.S., for example, the president submits to Congress a budget application, the House and Senate create bills for particular aspects of the budget, and then the President signs them into legislation..

EXPENDITURES

Expenditures are everything that a government actually pays money on, either its company registration services or such as social affairs, education, and foundation. Much of the government’s spending is a form of interest or property redistribution and company registration in Karachi, which is directed at serving society as a whole. The actual expenses may be greater than or less than the budget. .

NATIONAL DEBT

If the government has a deficit (spending is greater than revenue), it will fund the opposition by borrowing money and issuing national debt. In the U.S. the Treasury is accountable for issuing debt, and when there is a shortage, the Office of Debt Management (ODM) will make the decision to sell equity securities to investors. .

STABILIZATION FUNCTION

Fiscal policy has to be created by the government to control or achieve the goals of high employment or company registration services, a moderate degree of price level stability, soundness of international accounts, and an adequate rate of economic growth and company registration in Karachi. Fiscal policy is required for the stabilization of the economy and company registration services. Full employment and stability do not come about automatically in a market economy but require public policy guidance and company registration services. Without it, the market tends to be subject to ample changes, and it may suffer firm like company registration in Karachi and sustained periods of unemployment extension. .

SOURCES OF GOVERNMENT REVENUE

To perform the aforementioned duties efficiently the government must have resources or funds to finance the said projects. The government raises much of its finance through taxation or company registration services. Taxation is the most favored source of revenue among jurisdictions worldwide. Apart from guaranteeing the constant and continuous flow of revenue to the state revenue, taxation serves other fiscal policy goals as well.

The company registration in Karachi, government has to intervene to adjust the concentration of income and wealth to secure an appointment with what society considers a ‘fair’ or just country of distribution of income and wealth to ensure conformance with what society deems a ‘fair’ or just state of division. This fair or just distribution of income cannot be achieved under the exchange mechanism or company registration services. Under the market mechanism, the combination of income and capital depends first of all on the number of factor benefit and then managed by the process of factor endowment and then determined by the process of factor pricing, which in a competing market, sets factor returns according to the value of the limited production. .