The UAE has one of the world’s biggest per-capita earnings at $49,000. It has no individual income tax or capital profits taxation. Rather of making revenue from personal income, the country, which has the world’s seventh-largest crude oil also natural gas reserves, is reliant on money from oil companies that pay up to 55 percent in corporate taxation. Foreign banks pay about 20 percent. About 30 percent of the country’s gross domestic product (GDP) is directly based on oil also gas output, according to the Organization of the Petroleum Exporting Countries (OPEC).

- Have any questions?

- +92-322-2812976

- info@spectrum-consultancy.com

HOW TO DO BUSINESS REGISTRATION ONLINE?

January 9, 2020

REDUCTION OF TAXES ON IMPORT OF SMART PHONES BY FBR

January 18, 2020WHAT COUNTRIES HAVE NO INCOME TAX?

UNITED ARAB EMIRATES

QATAR

Gas-rich Qatar is the world’s wealthiest country with GDP per capita of $102,800, according to the CIA World Factbook. Qatar depends on its natural gas reserves — which are the world’s third-largest — for revenue. It has invested massively in infrastructure to liquefy as well as export the commodity. Companies concerned in oil also gas services face a 35 percent income tax rate. The nation levies no taxation on personal income tax, dividends, royalties, profits, capital gains, as well as property. Qatar nationals, though, have to pay 5 percent as income tax for social security benefits, whilst employers contribute 10 percent for the fund.

OMAN

Like neighboring Middle Eastern countries, Oman acquires the majority of its revenue from crude oil. In the first half of last year, Oman’s oil revenue, which accounts for nearly 70 percent of its total revenue, rose 30 percent to $13.7 billion from the same period in 2011, according to state statistics. Although there are no individual income tax or capital gains taxation in Oman, citizens must contribute 6.5 percent of their monthly salary for social security benefits. Stamp duty of 3 percent is also charged on the purchase of the property.

KUWAIT

With the world’s sixth-largest oil reserves, Kuwait’s petroleum accounts for nearly half its GDP, over 90 percent of export revenues as well as 80 percent of state income tax, according to OPEC. As you know there is no income tax in the country, Kuwaiti nationals have to contribute 7.5 percent of their payrolls for social security advantages; their employers make an 11 percent contribution. Notwithstanding being one of the world’s wealthiest countries per capita, strikes furthermore protests by public sector workers unhappy about pay have led the state to introduce a 25 percent increase in wages in 2012. Only 7 percent of Kuwaitis serve in the private sector, furthermore, the increasing cost of retirement could put pressure on state spending.

CAYMAN ISLANDS

Well known as an offshore financial center, the Cayman Islands are a huge draw for the wealthy with their zero individual income including capital gains taxation also because they have no necessary social security contributions. Employers, however, are required to provide a pension plan for all workers, including expatriates who have been working for a continuous nine months in the islands. Although there is no value-added income tax or state sales taxation, the country does have some indirect taxation such as import duties, which can range up to 25 percent.

BAHRAIN

With no personal income tax, Bahrain relies on output from the Abu Safa oilfield, which is shared with Saudi Arabia, for nearly 70 percent of its budget revenue. For social security benefits, citizens contribute 7 percent of their total income to the state, though expatriates pay 1 percent. Employers must also contribute 12 percent of a citizen’s income for social insurance, including pay 3 percent for expatriate employees. Emigrants also have to pay a 10 percent municipal income tax for renting a home in the Persian Gulf state.

BERMUDA

Considered one of the world’s most affluent countries, Bermuda also has among the world’s highest costs of living. Workers also have to pay $30.40 per week to social security insurance, which is matched by the employer. Other taxation includes a property tax of up to 19 percent depending on the annual rental value of the land determined by the state.

THE BAHAMAS

Amongst the wealthiest Caribbean countries, the Bahamas features an economy that’s massively dependent on tourism also offshore banking. About 70 percent of state revenue comes from duties on imported goods. Even though there is no personal income tax, employees have to contribute 3.9 percent of their salary, up to a maximum of $31,200 annually, for a form of social security called National Insurance. Employers also have to contribute 5.9 percent of a worker’s salary for National Insurance, tough self-employed individuals are charged 8.8 percent. The state also has a property tax of up to 1 percent.

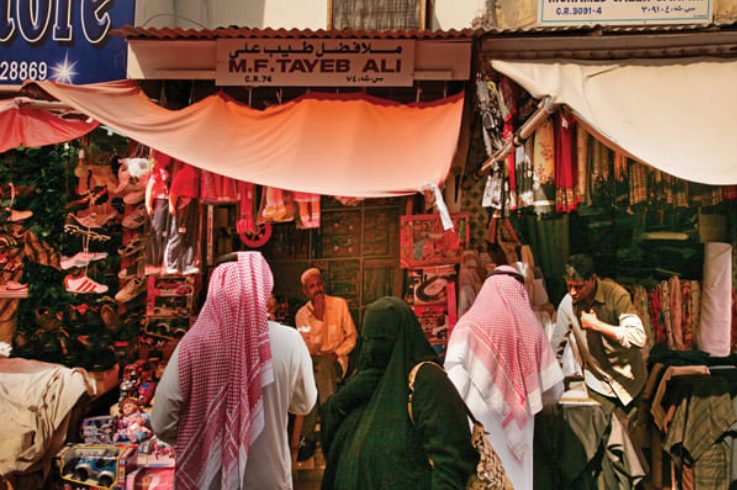

SAUDI ARABIA

Saudi Arabia, the world’s number one oil exporter, doesn’t impose an income tax on salaries, but self-employed ex-pats are taxed at a rate of 20 percent. Saudi workers give a grant of 9 percent of their salary for social protection benefits, though employers add another 9 percent. Other important taxes include a capital gains taxation of 20 percent. Petroleum is the major source of funding for the state, considering about 75 percent of budget revenues, 45 percent of GDP including 90 percent of export earnings, according to OPEC.

BRUNEI DARUSSALAM

Brunei Darussalam is the only Asian country to make the list of nations with zero income taxes. Although there is no income tax in Brunei, workers are required to provide 5 percent of their wages to a social security trust fund, plus 3.5 percent to a pension scheme, which is both matched by the employer. The wages of a non-resident director, though, are subject to a 20 percent withholding taxation.