How becoming a filer would advantage your country?

August 30, 2019

Trademark Registration- Information, advantages, and process.

August 30, 2019About GST (General Sales Tax) – GST Information & Advantages

What is GST?

General Sales Tax is a reform of Pakistan which adds to the revenue of the government. It is an indirect form of tax which is paid by the consumers. After that, the seller is supposed to forward the General Sales Tax to the government. General Sales Tax is presumed to bring betterment in the revenue. The merchandisers add the General Sales Tax to the price of the service or product. The buyer has to pay the General Sales Tax along with the sales price. In some countries, General Sales Tax is referred to as VAT (Value added tax) In Pakistan now it is receiving a lot of significance. However, there is a lack of awareness, and many people have no idea about how to make General Sales Tax for business. But, here at Spectrum Consultancy, we have made it easier for everyone. With our assistance, you can get your GST registration number online!

Some more information about GST:

The General Sales Tax was first implemented in France in 1954. It was implemented in Pakistan in 1990 by the local government under the guidance of IMF technical teams. Now many countries have legislated this General Sales Tax reform including Canada, UK, Australia, Singapore, Italy, Nigeria, Spain, India, etc.

How General Sales Tax works?

Many countries apply a direct tax system in which a single rate of General Sales Tax is implemented over the country. This means that these countries collect central tax and state-level taxes as one single tax. The central tax includes sales tax, service tax, and excise duty tax. Whereas, the state-level tax includes entry tax, luxury tax, entertainment tax, sin tax, and transfer tax.

GST in Canada and Brazil:

The General Sales Tax system in Canada and Brazil is different from other countries. They perform a dual tax structure. In dual structure, the federal GST is applied in addition to the state sales tax.

How GST works in Pakistan?

Pakistan works on a unified GST system.

- The standard rates of GST in Pakistan are 17%.

- In Sindh, the sales tax on services is 13%

- In Punjab, the sales tax on services is 16%

- In Balochistan and KPK the sales tax on services is 15%

The highest sales tax is in Bhutan which is 50%

What are the uses of the General Sales Tax?

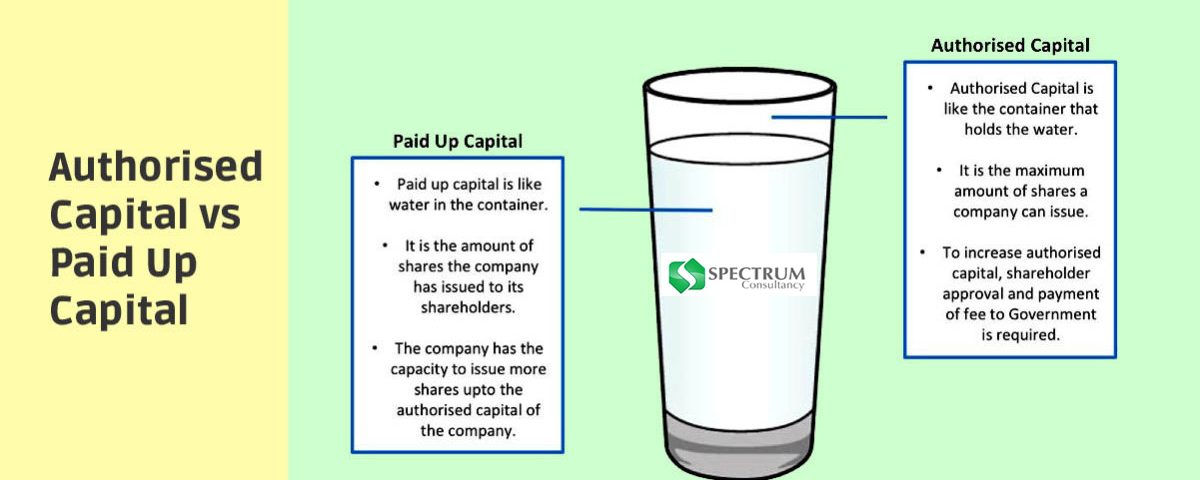

- GST reduces the multiplicity of taxes. As explained above, GST gathers all taxes under one umbrella. Instead of paying different taxes such as central and statelevel, you will only have to pay a single tax.

- The reduction of tax on tax occurs. This happens when a product has to be taxed on every stage of its production to its consumption. Thus, the final consumer has to bear all the taxes as it leads to extraordinary prices.

- Uniform tax is another big advantage of GST. Taxes become the same, which also reduces corruption.

- The simple online process has made GST registration even easier. If you want to get your GST registration number, you should contact us now.

- GST registration makes filing easier. Because then you do not have to add multiple taxes while filing, you can do it easily.

There are many other advantages!

What are the disadvantages of online GST?

The only disadvantage of getting an online GST registration number is that many people would find it difficult. As everyone is used to manual GST registration, it would be a challenging task for them to adapt to the online system. But, we have a solution for this too. Along with online registration, we also offer manual GST registration. Therefore, you do not have to go anywhere else. We are all under one umbrella solution for you. We know that the online system is simpler, but we have made the manual one also easier. All you have to do is to get your phone, and dial or text on +92 322 2812976

We are sure that after reading the complete article, you will have enough information about GST registration. Along with offering quality services, we also make sure that our clients are served with awareness too. It is important because if you don’t know about something, then you will be easily misled. But, here at Spectrum Consultancy, we make sure that you are served quality and expert services. We are all under one umbrella solution for your taxation complexities. From return filing to online GST and NTN registration we offer everything to our clients.